Private health insurance is insurance to pay for hospital accommodation, procedures and other health treatments known as extras or ancillaries.

What is private health insurance?

Private health insurance is insurance to pay for hospital accommodation and procedures (in public or private hospitals), and to pay for treatment for other health treatments like dental, optical and physio, known as extras or ancillaries. It is not compulsory but is encouraged through the taxation system.

Hospital cover – treatment in hospitals or in hospital out patient facilities for services that are on the Medicare schedule. There are thousands of different items on the schedule which add complexity for the consumer. The insurance covers hospital services and the treatment.

Extras cover – dental, optical, physio, chiro and an array of other services. Again there are thousands of item numbers.

Package cover – both are sold together.

Hospital cover

Insurers are only allowed to provide hospital cover for the range of treatments that are on the Medicare schedule. This means that there will be treatments for which there may be demand where you will not be able to get cover. An example might be plastic surgery. Cosmetic plastic surgery is not available. However if you need plastic surgery as a result of another surgery or to improve your breathing, you may be covered.

Understanding what is included in your cover can be tricky. Insurers’ websites will list inclusions, but they are often just listing the major items that they know consumers are searching for. In fact their policy may cover an array of other treatments that the consumer might never have heard of.

Externally insurers report to Private Health Insurance Ombudsman (PHIO) advising which treatments are covered by the policy from the long Medicare schedule list. PHIO then publishes a SIS telling the consumers which treatments are not covered but from a shortlist of common conditions. Sounds confusing because it is.

What to look for in a policy

Always a balance of price and features/benefits. One should never buy on price alone as there are policies that cover for virtually nothing. People are calling them junk policies. But don’t lose sight of price – there are roughly equivalent policies with very different pricing.

Beyond price, what to look for

- What treatments am I covered for

- The qualification period

- How much do I get back

Different treatments matter at different life stages

- Young people who have pipped above $80,000 income, may simply be looking to avoid the Medicare levy surcharge by taking cover. But what’s the point if you pay away the same dollars and get zero cover for it. Maybe pay $10 more a month and get cover for some treatments.

- Middle aged and mature people should consider policies with full cardiac cover, this being the biggest killer in Australia

- Older people are likely to need cataract surgery and some form of joint replacement.

- Young people who play sport are more likely to need a knee reconstruction.

- Obstetrics is obvious if you are planning family, but it means a high cost policy and you will be up for a hefty medical gap for your obstetrician.

- Psychology is a high incidence claim for young people and families with teenagers.

- Any strong family history of a specific condition should trigger an enquiry to your prospective health insurer to confirm cover.

Be aware though that full cover for treatments like obstetrics, psychiatry and joint replacement mean that your policy will be high premium.

All shades of black, white & grey – Restricted, excluded, waiting period, excess, etc.

Cover can fall into several categories:

- Covered – meaning fully covered

- Restricted – meaning that your room is covered but not the treatment, but sometimes can mean something else altogether

- Excluded – that’s clear, you’re not covered

- Benefit limitation period – you’re fully covered eventually but only for a lesser percentage for a year or two

- Waiting period – you’re covered, but only after you have held the policy (or an equivalent one with your insurer or another insurer) for a year or maybe two

- Excess on your policy can vary which means that you will be up for the first $300, $500, etc. of any claim

- Co-payment meaning you might be up for the first $100 or so for each day of your stay in hospital (which is capped at various # days)

- Even if you are fully covered, you could well be up for a medical gap paid to your specialist, which you pay – this could be a known gap or an unknown gap (but it is all unknown to you when you take out the policy).

There is nothing straightforward in this industry.

Waiting periods mean you have to plan in advance

If taking cover for some specific future treatment, make sure that you are taking it soon enough in terms of waiting periods and benefit limitation periods. And take out full cover, not restricted.

Obstetrics is a great example of a treatment that has a long waiting period.

How much do I get back?

Here’s where it gets even trickier.

Payment for the hospital and room are straightforward. Your insurer negotiates a cost with the hospital and covers it (for full cover). You pay the premium. Most private hospitals are part of the deal, which means your insurer pays the full amount of the hospital accommodation bill minus your policy excess or co-payment.

Most doctors are not prepared to do a deal. Even those that do a deal retain the right to set if aside should they choose. This is medical gap. Before your treatment you should get a quote from your doctor and find out from your fund how much they will pay. The difference is medical gap, and it can be reasonable or it can be unaffordable. A quote is easy if you have the planning time but less so when you are under stress and feeling life-threatened.

Unfortunately you cannot know what medical gap will be when you take out a policy, as it is treatment dependent, doctor dependent and individual patient dependent.

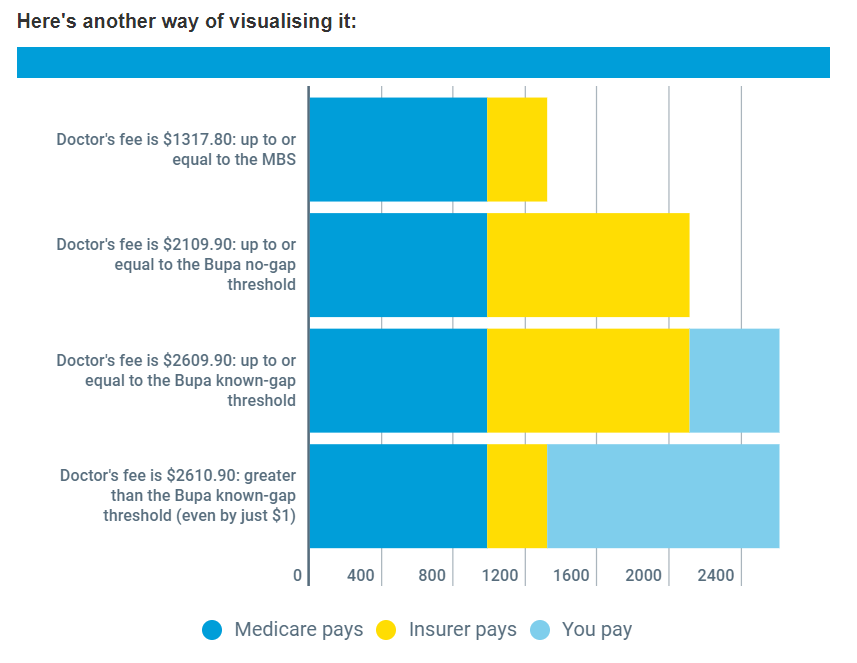

Medical Gap

For your medical treatment, Medicare pays your doctor 75% of the Medicare schedule for the treatment item. Your health insurer pays the other 25% to the doctor. But this is rarely enough to get your doctor out of bed.

He will be guided by the Australian Medical Association (AMA) recommended fee for the item. But he could bill for more.

Either way your insurer will not always pay the full amount of the bill – this is the medical gap, made up of:

- Known gap

- Unknown gap

You can work this out at the time of the treatment but not when you buy the policy. The good thing is that the Ombudsman publishes statistics on gap in the State of the Health Funds Report. It is fundwide and not policy specific but at least it gives some guide.

Here’s how one insurer has tried to simplify it.

Ultimately you have to work out what treatments are covered by the policy, whether they are fully or partially covered and how much you will be out of pocket for the treatment and hospitalisation. All when you are buying the policy for a set of unknown future health conditions. You end up taking a lot on trust.

Extras Cover

Extras cover is not as tightly regulated as hospital, with the result that a wide range of extras treatments are included – from the big four of dental, optical, physio and chiro through to massage and kinesiology. Signing up for extras does not avoid the Medicare levy surcharge, but the benefit of the rebate still applies to extras premiums.

There is also a difference in the way consumers should view extras relative to hospital. Hospital cover for most people is a genuine insurance that people would expect and hope to use infrequently if at all. It is there to cover the big health event. Extras is much more likely to be claimed – annual dental visit, new glasses, etc. – but they are not the lifechanging and financially challenging events. It could more be viewed as a payment plan for those expenses. For this reason if you are not receiving benefits greater than or close to your premium you should be considering whether the cover is worthwhile.

The thing hospital cover and extras have in common is that for both it is difficult to understand what you are actually covered for and exactly how much you will receive.

What is covered in extras

Policies can be widely varied and can contain all or any combination of the following:

- Dental – general dental, complex dental, major dental, orthodontics

- Optical and laser surgery

- Physiotherapy

- Chiropractic

- Osteotherapy

- Natural therapies

- Massage

- Pharmacy

- Psychology

- Hypnotherapy

- Diet and nutrition

The longer the list, the better the product? NO. Somewhere around 80% of claim value and number is in the big four – dental, optical, physio, chiro. Consumers should look at the comprehensive list and honestly answer, am I likely to use this service? If the answer is no, don’t factor a whole lot of value into it being available.

Look for a cover that gives you what you need, with maybe a little bit of credit for what you want.

Gap

- The dreaded gap matters for extras also, but here it is more likely called out-of-pockets. There is no excess as there is for hospital, but there is a gap determined by the combination of limits restricting claiming.There are various limits on claims:

- Item limits – either a $ benefit paid per item (there are thousands of items) or a percentage of the service fee paid

- Category limits – eg. all item claims added up to the dental category

- Sub-category limits

- Per person limits – On couple or family cover

- Overall limit – an absolute limit on the benefit paid

A policy can have any combination of these.

The only way to be absolutely sure of what represents value to you is to capture what you typically spend on which services for which family member and put that claiming behaviour through the filters of those limits. The outcome is the benefit paid and the out-of-pocket expense to you.

Waiting periods also matter for Extras

- You are going to have a waiting period for big ticket items like orthodontics and it can be quite extended.

- You have to plan ahead for this if the writing is on the wall.

Life and family stage matter for Extras too

What you need now will change as you age and the claim magnitude will be influenced by the number of people on the policy. (It is true that families are covered for the same premium as couples, but the limits don’t multiply by the size of the family.)

Some sample scenarios:

- You might be likely to have a claim for a hearing aid when you’re in your 70’s.

- A family of teenagers will be customers of the orthodontist.

- Two short sighted parents with 3 kids will probably have five people claiming for glasses.

Think about this when choosing a policy.

Extras cover doesn’t have as many moving parts or grey areas as hospital cover, your claiming behaviour is more predictable and you have precedent for the size of the bill. It is far easier to understand value, but it still requires more effort than most people are prepared to put in. However the right choice can represent thousands of dollars, not just in premium saved, but also in lower out-of-pockets.

Package

Most policies are sold as a combination of hospital and extras, whether though formal productised packaging or through the sales process. The insurers are able to cross subsidise the hospital cover from a profitable extras policy.

Buyers might do better however by considering the two as distinct products and use subsidisation to their advantage, not to their detriment.

The Industry - How Australians pay for health care

Australia has a hybrid public – private system for the funding of health services, making the administration of the system extraordinarily complex as government attempts to balance an array of stakeholders.

Public hospitals – provide free high quality hospital and outpatient care to Australians and Kiwis. They are a good option for urgent care, but are prone to long waiting time for treatment for elective procedures (those that are not life threatening). You do not have your own choice of doctor.

Private hospitals – provide the same services but waiting times are not as great a problem and you have your choice of doctor (your doctor will guide you to the private hospital where he operates). Of course, the consumer pays. If insured, the private health insurer pays for all or part of the hospital accommodation and other hospital services and care minus your excess.

Local GP – provides general medical care. Services are partially paid for by Medicare, nothing to do with private health insurance. A small proportion of GP’s bulk bill or bulk bill for some consumers, like students or pensioners, which means that the patient pays nothing out of their pocket.

Specialists – With a referral from a GP, Medicare will pay some but rarely all of the cost. When treated in the doctors rooms, there is no claim against private health insurance. When treated in the hospital, the treatment is fully or partly paid by your private health insurer.

Ancillary health services (dentists, physios, chiros, optical dispensers, etc.) – Not covered by Medicare (except for your optometrist), but fully or partly covered by your health insurer if you have extras cover.

Private health insurance fulfils a social role

Insurance is a sharing of risk and the cost across the community. It relies on a lot of people joining up and paying a premium, and a smaller number making a claim on the policy.

Health insurance is the purest form of insurance in Australia, in that you pay the same premium whether you are 28 or 82. It is community rated, meaning that the risk and cost are shared evenly across the whole community. Other forms of insurance are risk rated, such that individuals are fit into risk categories, based on factors like age, occupation, postcode, health and family history, etc.

It is also highly regulated. In addition to community rating, premium increases can only occur once a year and only if approved by the Health Minister. It can only provide coverage for approved procedures.

The industry exists because the cost to the budget of health services is huge and growing, and government can’t see a way to fully fund it from consolidated revenue (in spite of taxpayers paying a Medicare levy with their tax). The private system takes up the slack, funded by individuals and their insurance premiums.

The quid pro quo is tax inducement for membership

The government encourages people out of the public system and into the private system through the taxation system. The stick is that taxpayers earning over $80,000 for singles / $160,000 for couples pay a Medicare levy surcharge of 1% (and up to 1.5%) if they are not members of private health insurance. The carrot is that the government gives a tax rebate (at various levels depending on age and income) on your private health insurance premium.

In other words, you provide services this way and we guarantee you high membership.

What community rating means for premiums

For life insurance these are risk factors taken into calculation of the premium – age, gender, pre-existing conditions, family history, occupation, smoking, etc., etc.

Community rating means that none of these matter and the 28 year old in great health pays as much for the same cover as an 82 year old in very poor health. With claims as you would expect for these two groups, the young and fit are subsidising the old and infirm. The 80/20 rule applies, 80% of the claims $’s by 20% of the members.

At the same time government restricts premium increases by withholding ministerial approval. Increases have been held to around 6% for years, well above inflation but below escalation of health care costs and claims costs. The government claimed a victory in 2018 when it held the average increase to 4% (which it managed by legislating the cost of prosthetics) and the opposition leader has pledged to cap increases at 2%.

It all sounds a good deal for consumers, but is it?

So how does the industry cope with the cost pressure?

Think about the 2% cap first (and premium increase restrictions generally). What will happen is that the insurers will make policies that are too generous unavailable for purchase – “closed”. They will then bring out new higher premium or lower benefit policies for sale. The closed policy will continue for existing customers and gradually run off. The cap is destined to fail.

As for community rating, the industry deals with this through product design. We would never recommend a policy for an older person that does not have full cover for certain treatments that become prevalent claims, like cardiac and hip replacement. The industry builds products that include these types of policies and attaches high premiums. The objective is to have the higher claimers taking out the higher priced policies, while cheaper options exist for the young.

What’s to stop an insurer providing only ridiculously overpriced policies for those inclusions sought by high claiming group, so that it only attracts the young and healthy. The government has built an equalisation pool to deter this. An insurer contributes to the pool for each young member and withdraws from the pool for each old member, going some way to smoothing out the claims issue. Insurers also know that as people age they are less likely to upset their health insurance arrangements, and that lower claiming customers migrate to higher claiming customers. All of this promotes a long term view to encourage balance in their product portfolio.

Why not just rely on the public system at no cost?

The public hospital system provides high quality treatment and there is no evidence of better health outcomes in private hospitals.

However there are some advantages:

- The rooms are more private, usually on your own or with one other patient (depending on the hospital) and the accommodation and food of higher standard.

- You get your choice of doctor. In public hospital you will see the duty physician or specialist, and it could be a different one every time. In private hospitals, you will consult your specialist and be told which hospital she attends, and you will see that doctor throughout your treatment. A bigger advantage for people with an ongoing need for hospital treatment, and often a strong preference where there is a stronger relationship with the practitioner, like child birth.

- Public systems can have long waiting lists for elective surgery. The definition of elective can go to the period of time before health outcomes are negatively impacted. It means that treatments like knee reconstructions can have an extended waiting period.

- You move over the $80,000 income level ($160,000 for family) and will now be taxed with the Medicare Levy Surcharge of 1.0%. Putting a similar amount into private hospital cover will avoid this surcharge.

- You are turning 31 this year and expect to take out health insurance some time in the future. If you don’t take out cover by 30/6, when you do eventually take up insurance you will be up for a 2% lifetime loading on your premium for every year you did not have insurance beyond this year (max loading is 20%).

- You wish to cover for Extras which have only very limited public funding. In particular you might have an expectation of a large cost for some upcoming treatment, like two teenage children in the family who are going to need braces.

How compelling these motivations are will vary for individuals and life stage.

Why not just rely on the public system at no cost?

The public hospital system provides high quality treatment and there is no evidence of better health outcomes in private hospitals.

However there are some advantages:

- The rooms are more private, usually on your own or with one other patient (depending on the hospital) and the accommodation and food of higher standard.

- You get your choice of doctor. In public hospital you will see the duty physician or specialist, and it could be a different one every time. In private hospitals, you will consult your specialist and be told which hospital she attends, and you will see that doctor throughout your treatment. A bigger advantage for people with an ongoing need for hospital treatment, and often a strong preference where there is a stronger relationship with the practitioner, like child birth.

- Public systems can have long waiting lists for elective surgery. The definition of elective can go to the period of time before health outcomes are negatively impacted. It means that treatments like knee reconstructions can have an extended waiting period.

- You move over the $80,000 income level ($160,000 for family) and will now be taxed with the Medicare Levy Surcharge of 1.0%. Putting a similar amount into private hospital cover will avoid this surcharge.

- You are turning 31 this year and expect to take out health insurance some time in the future. If you don’t take out cover by 30/6, when you do eventually take up insurance you will be up for a 2% lifetime loading on your premium for every year you did not have insurance beyond this year (max loading is 20%).

- You wish to cover for Extras which have only very limited public funding. In particular you might have an expectation of a large cost for some upcoming treatment, like two teenage children in the family who are going to need braces.

How compelling these motivations are will vary for individuals and life stage.

Private health insurers – The Players

Two behemoths and a close follower – Medibank Private, Bupa, HCF

Large followers – NIB, HBF, AHM (sub of Medibank), Australian Unity, GMHBA

Small providers – a long tail of small players, most not-for-profit and many state based or regional

The larger providers are able to dominate extras using their muscle to establish networks of dentists, optical stores, phyios and chiros who agree to a fixed fee for services, discounted for the health insurers. These benefits can be passed on to members as either lower out-of-pockets or subsidy for the packaged premium.

The smaller providers are able to compete vigorously in hospital, where network arrangements with hospitals are outsourced to a couple of intermediaries who are able to negotiate with power.

How you can buy health insurance

- Direct from private health insurer

- At branch

- Over the phone

- Online – the complexity of the product means that many people feel the need to talk to a person for some reassurance

- Brokers – there has long been a broker channel though not widely used.

- Comparison sites listing and comparing multiple brands. The market leaders run a call centre model to close sales. Other models do more to assist consumers with choice of policy online and then direct them to the insurers website for close.

Controversies

- It is near impossible for consumers to understand what they are covered for, how much out-of-pocket they will be up for. Policies are so complex.

- The cost of health insurance goes up every year and by well in advance of inflation – in the past 10 years by round 6% every year until 20018.

- Provision of hospital and medical costs keep escalating, with little incentive for cost control and an industry structure and behaviour that dies not encourage competition.

- Doctors will not allow themselves to be pinned down to a schedule of fees so the gap cannot be estimated until a firm quote is given for a known procedure. The insurer and the patient are both in the dark until then.

- The insurers are squeezed between escalating claims amounts and premium control by the Health Minister. Their answer is to cut back on benefits, leading to customer shock at declined claims and high and unexpected out-of-pockets.

- It means that the older profit challenged policies are closed to new customers and grandfathered (existing customers can stay in them). The number of closed policies is several times the number that are open for sale.

- Public hospitals take the opportunity to treat patients as private patients if they become aware that they are insured, transferring the budget burden to insurers. Patients are worse off, having to pay excess.

- Participation rates are in decline in spite of the tax incentives, as consumers feel that membership is not worthwhile.

- The private-public funding of health care means that government is conflicted in administering the industry.

- Threats of removal of the rebate will make insurance unaffordable.

- The industry is highly divided, with AMA sniping and hospitals resisting attempts at cost control from insurers, political threats and consumers at the end of the chain left confused and shocked at claim time.

- Otherwise all good.