Insurance is not about winning the lottery. It is about replacing the financial capacity that you provided for yourself or your dependents.

What is insurance generally?

Personally, insurance is a bet that some unwelcome event happens to you. If the event occurs, you win the bet. Effectively you are betting against yourself.

For car insurance, you are betting that your car will be involved in an accident, break-in or theft. For life insurance you are betting that you will die or have a serious illness or accident during the currency of the policy.

Now of course you’re not hoping to win the bet ……. it’s a “just in case” bet. Even if you don’t win the bet, you win because you have still bought the ability to get on with life – to be prepared to have family, to take the risk of buying a home, to start a business. You’ve enjoyed the peace of mind that your dependents will get by without you.

Insurance is not about winning the lottery. It is about replacing the financial capacity that you provided for yourself or your dependents.

Socially, insurance is a sharing of risk and the cost across the community. It relies on a lot of people joining up and paying a premium, and a smaller number making a claim on the policy.

The purest form of insurance in Australia is health insurance where you pay the same premium whether you are 28 or 82. It is community rated, meaning that the risk and cost are shared evenly across the whole community.

Life insurance is risk rated, meaning that you pay a higher premium if you fall into a risk category based on a combination of many risk factors. Those factors discussed later.

What are the types of life insurance?

Life insurance is not just about dying. Some forms of cover are also about living.

The different types of cover under the broad heading of life insurance are.

- Term Life, but more accurately death cover (the industry tries to avoid calling it that)

- Total and Permanent Disability cover. This is usually sold with term life. It pays you a lump sum if you contract some illness or injury that will prevent you from working again. It is designed to help support you and your family now that your income is diminished.

- Trauma cover. Also known as critical illness. It pays you a lump sum (or in some cases a series of lump sums as you progress through seriousness of the illness) if you contract some serious illness or injury. Think heart attack or some grades of cancer. In the case of very serious injuries, you may be paid out fully on the policy, while for some lesser health events, a smaller figure. It is designed to help you financially deal with the recovery and the life changes made necessary by the health event.

- Income Protection. It pays you a salary, up to 75% / 80% of your income, in the event that a defined illness or injury stops you from working. Some policies pay you an income for only 2 years while others may be up to age 70 (though for these they will usually be paid out as a lump sum well before then). It’s designed to make ends meet during the period that you can’t work.

- Funeral insurance. It is just a form of death cover for a smaller amount than other policies. It pays a lump sum in the event of death and is designed to cover funeral and related costs to take that burden off your family.

In all cases the policy document defines the events that will be covered by the policy and those that will be specifically excluded. There is no “open slather” approach, though death cover is relatively straightforward.

When and why do you need insurance?

We’re all going to die, but that doesn’t mean that we all need insurance.

If you’re young and healthy and have no financial dependents, you have less need for life insurance. You’ll be missed but financially your relatives will get by. Of course you could have an accident or illness that means you can’t work for a period or ever again. It is of course a trade-off between protection and the cost of the cover, the premium.

The story is different when you have family of your own, financial dependents. You then want to know that they will be provided for, when you no longer can.

Does buying a home and taking out a loan per se mean you should have life insurance? If you have no dependents and die, the house will be sold and the bank repaid. If there is a shortfall, it won’t be so much and the bank will cover it. If you can’t work because of illness or injury, the trauma, income protection or TPD cover can help with the repayments.

So, some form of insurance makes sense for everyone, but of course it does not come cheaply, and it is more critical for some than others.

How can you buy insurance?

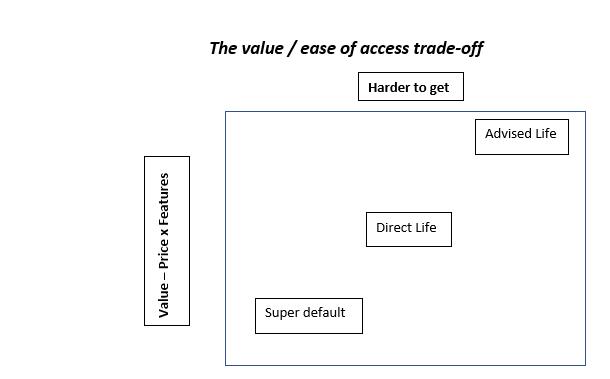

Life insurance is available through various channels.

- Direct – online and by phone. For death, TPD, income protection (but not by so many for IP). It is normally a more packaged up offering, has easier underwriting, and relies more on exclusions for pre-existing conditions (PEC’s). It is easier to get than advised but might not be as good or as cost effective.

- Insurance adviser – for the full package (usually try to sell three or four of term life, TPD, trauma, IP). You meet with an adviser and fill out an insurance proposal. There is a high level of personal disclosure from you and you might have to undergo a medical in a comprehensive underwriting process. It can be harder to get, but there is more certainty at claims times due to fewer PEC’s. Usually better quality cover and can be a lower premium.

- Your superannuation (sometimes called group life) – direct life and TPD, income protection (again not by so many for IP). You can get advised life through your super also but the cover referred to here is default cover. Varies a lot, but generally the $ level of cover is low and probably inadequate for family people with a home loan. Easier to get default cover as it comes automatically with your super and there is no underwriting.

Choice of channel is effectively a trade-off between ease of the purchasing process and the quality and value of the product. A policy that is not underwritten will generally have either more extensive exclusions or come at a higher price than one that is fully underwritten. However the underwriting process could even preclude some would-be purchasers from that set of products.

As always, there are exceptions to this general rule.

How do insurers work out the premium?

- Underwriting is the risk assessment undertaken by the insurer. It is the process undertaken to determine whether the insurer will accept the risk (ie. issue a policy) and price the policy (a loading may be added to your premium if you have risk factors).

- The more risk factors you have the higher the premium you will pay

- Age

- Gender

- PECS

- Family history

- Occupation

- Smoking

- Etc.

- You may need to undertake a medical before the insurer will issue a policy.

- Direct insurers tend to have a more simple approach which is less likely to uncover pre-existing health conditions. This is why they generally rely on more exclusions (things the policy doesn’t cover) in the policy. The problem can be that you only realise you are not covered for something at claim time, whereas the underwriting process may have made this clear at the outset.

- The other point to be very clear about is that you must tell the truth in your application. The insurer is giving you a promise to pay a claim on certain events and this promise is given on the basis of the facts as you have disclosed them. Don’t run the risk of voiding the policy by misleading the insurer.

- Another aspect to be aware of is that, even though your health is currently good, health issues could arise in the future that make you uninsurable. The premiums you are paying now might be an investment in your future access to cover, without an extra loading. The insurer is committing to continue to renew the policy if you pay the premium.

How do life insurance premiums behave over time?

As you age your premiums also rise. The problem is that coverage that looks affordable now at age 35 can start looking unaffordable at age 55. At some point the curve becomes exponential.

An option for dealing with this is to take a level premium policy. Premiums traditionally have been stepped, such that as you age they go up. Level premiums can rise as administration costs, etc go up, but the insurer doesn’t add the extra loading for age. The catch is that you start on higher premiums. It also locks you into a policy with the one insurer.

What else do I need to know when buying a policy

- Can I get cover – do I qualify for life insurance with this provider

- What medical conditions am I covered for and what is excluded.

- What are the $ benefits paid, are there waiting periods, do benefits cease at some future (especially for IP)

Life insurers – The Players

Advised life –

- The big banks and traditional insurers – AMP, Zurich, TAL, AIA

- The field has not grown in many years and Australian providers are selling off their life insurance businesses to Japanese insurers.

Direct Life

- A much larger field and growing

- Traditional insurers, general insurance entrants, retailers,start-ups

Superannuation

- Industry super funds, who provide default group insurance

- The insurance provided by retail super funds is not a default offering and is the advised life product sold through a referred adviser.

Controversies / developments

- Underinsurance – Australians are underinsured, such that for most families who suffer the loss of the principle income earner become reliant on social support. Affordability is the problem.

- If you are not claiming against your policy, the premiums are diminishing your savings (whether super or otherwise).

- The government is moving to make the superannuation default setting for under 25’s zero. They will have to opt into insurance, not out as previously, and we know they will not do this in great numbers.

- Life insurers are floating the idea of moving into the “health insurance” space, by designing rehabilitation style products. They have not suggested that they are prepared to offer cover on a community rating basis, which would probably make the move unattractive.

- The industry has been under attack on claims denials. CommInsure has been the most public case, with outdated heart attack definitions.

- Advice – independence of advice, quality of advice, fees for no advice