The home loan is the enabler to home ownership.

What is a home loan?

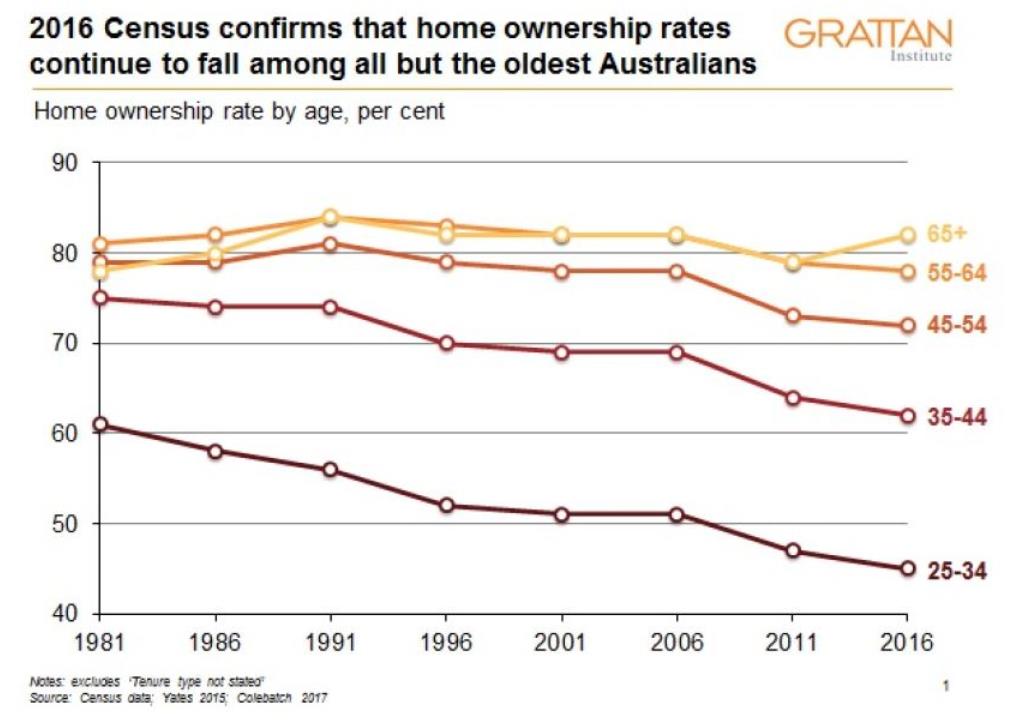

Owning your own home has long been the “great Australian dream”, and most Australian adults still aspire to buy their own home at some stage in life. However, home ownership is in long term decline across all generations but the baby boomers. Nonetheless 45% of 25 to 34 year olds and over 60% of 35 to 44 year olds did own their own houses as at the 2015 census. It is far from a lost cause for younger adults.

The home loan is the enabler to home ownership. Few buyers can put their hand in their pocket and pay $600,000 cash for a house. Saving $60,000 plus stamp duty and other costs is viable over a few years, especially for a two income household.

The home loan covers the difference between the purchase price plus costs and the cash on hand. The bank provides the $540,000 at settlement (the exchange of title for the contracted purchase price) and the buyer hands over their $60,000 to the seller and funds to cover the costs to the bank.

The buyer commits to repay the loan over 30 years in monthly payments and signs a mortgage with the bank giving the right to sell the property in repayment of the loan should the borrower default.

Different types of home loans – interest rates

- Variable interest rates – these may vary at any time during the course of the loan. With bigger lenders, they are tied to an indicator rate, commonly called the standard variable rate. It is done this way because the bigger banks manage a portfolio of different loans, and the bank is able to manage ongoing margins and relativity of different loan types just by varying the one rate. This standard variable rate is discounted by say a package discount of 0.7% or some other discount factor to deliver the rate the customer pays.

- Fixed rate loans – this rate is fixed at the date of drawdown / settlement for an agreed term, usually 2 or 3 years, but for as short a period as 1 year or as long as 5 years. Customers might see this as the avenue to lower rates, but are notorious for fixing their loans at the wrong time, after the pain of repeated rate increases becomes too great. It is at this point that rates will be nearing their peak, making fixing the loan a poor call. The legitimate reason for fixing is to set repayments at an affordable level for the 2 or 3 years. At the end of the fixed period, the rate “reverts” to a variable rate, usually well above the fixed rate.

The ability to vary rates, whether at the outset or after the fixed period, sounds odd relative to any other purchase contract, where the price is agreed. It is necessitated by the long term nature of the loan contract, which the bank can only fund with short term deposits, raised at different points in the interest rate cycle.

Rates are loosely tied to the Reserve Bank of Australia Cash Rate, fixed by the RBA Board on the first Tuesday of each month except January. The Cash Rate is an indicator of how the Reserve Bank will be managing the money supply, which will flow through to deposit rate, and other bank funding costs. However the banks are under no compulsion to move lending rates in alignment with the Cash Rate.

Different types of loans – repayment options

- Principal and interest – The traditional loan payment covers principal reductions and interest, set at a level to repay the loan over the agreed term.

- Interest only – A more recent addition has been interest only loans which cover the interest but don’t reduce the principal (the amount outstanding on the loan). After 5 years on interest only the $540,000 remains at $540,000. The interest only loan period is usually 5 years, but some lenders allow 10 years, after which time the loan payments are re-set to repay the loan within the original term – say 30 years from the first drawdown of the loan, not 30 years from today.

Interest only loans exist to get people into home loans who can’t afford at the outset to repay the principal, and to accommodate investors who wish to preserve the tax deductibility of the loan (more on this later).

Different types of loans - differently featured loans

- Package Loans – the loan most frequently provided by the big banks over the past. For one package the borrower gets the loan discounted 0.5%/ 0.7% or more below standard variable, a credit card, a free transaction account and a range of discount offers. To qualify the loan amount has to be above a minimum, usually round $150,000, meaning that some old loans nearing the end of their life might not qualify.

- Basic Loans – originally these loans were quite inflexible, with restrictions on making extra repayments and early repayment, and no offset or redraw (more on these features later). Now they generally have the flexibility, albeit that redraw might be more restricted or come at a cost. They usually don’t have offset.

- Standard Variable Loans – a small rump of loans written many years ago, usually with low $ outstanding and running off.

- Introductory Loans – loans offered to new borrowers at a lower rate for the first couple of years, that then “revert” to a higher rate.

- Construction Loans – for the construction of a house. They allow for progressive drawdowns as different stages of construction are reached.

Different types of borrowers

- Owner occupiers – who will reside in the house being purchased.

- Investors – who will rent out the property. The gearing opportunity makes property investment attractive relative to other classes of investment. Interest, depreciation and other expenses are allowable deductions against income. Where these costs exceed rental income they can also be claimed against the salary of the investor. This is known as negative gearing and controversially makes borrowing for property investment even more attractive.

- First home buyers – A sub-set of owner occupiers but with special needs as they have not been through the process before and due to the degree of difficulty in reaching deposit requirements.

What to look for in a home loan

There are a few key things that you must have:

- Most importantly don’t pay too much. The home loan is likely to be the biggest financial commitment you will make and paying 0.5% too much will mean paying $100,000 plus too much over the life of the loan. Don’t be in the silent majority that are not reviewing their loan.

- Also watch the fees – they can mount up.

- Flexibility to make extra repayments is critical. When taking out your first loan you might not envisage a time when you will be able make additional repayments, but if history is any guide, that time will come. Clearing you loan early will be one of the best investments you will ever make.

- The enabler to make extra repayments is redraw. Redraw means that if you are ahead on you repayments you can pull the amount bank out of your loan if you need the cash. Having this fall back gives you the confidence to put as much into your loan as possible.

- The alternative to redraw is offset. Offset is a deposit account that doesn’t pay you interest, but instead offsets the like amount in your loan so that interest is not charged on that part of your loan. Like redraw, if you need to access the cash you can, and as less of your repayment goes towards interest, more goes towards reducing your principal and paying the loan off early.

- The beauty of redraw and offset is that you effectively receive the home loan interest rate, averaging around 4.5% compared to the better savings rates round 2.5%. The drawback is that you don’t get the interest in the immediate term, but it is worth it for the long term benefit.

There are all sorts of other aspects of the loan and the lender that matter, but the online world has been a great leveller.

How to qualify for a loan

Any lender is interested in three things when considering a home loan application:

- Do you have the capacity to repay the loan

- Are you likely to repay

- Will the loan be adequately secured

A pass mark is required for all three pieces of assessment.

Capacity to repay

Many years back lenders worked on strict budgets, capturing all the details of the household income and expenses to understand the borrower’s capacity. More recently there has been a move to a more formulaic approach, with rules of thumb for the percentage of income that can be allocated for loan repayments and an estimate of household expenses based on a percentage of income. These estimates streamlined the application process.

However the thinking has now gone full circle, with ASIC fining Westpac $35m for breaching its responsible lending obligations, in using the formulaic approach and not capturing detail of applicants’ individual circumstances.

Looking forward, any formula will only be a guideline and actual individual budgets will have to be considered. The result has been a toughening up of lending standards, and the likelihood that loans will become more difficult to get.

Likelihood to repay

History is the best guide. If you have a strong record with your lender, you will be regarded as a person who is likely to continue to repay on time every time.

Of course you might have no record with the lender of choice. The lender will want to see evidence of prior loan repayments being made – statements showing repayments. A credit bureau report will fill in the gaps and the credit score, incorporating repayment history, current credit, defaults, credit enquiries, etc., will be an input to the loan assessment.

Security

Is the value of the property adequate? Lenders are generally prepared to lend an amount up to 80% of the assessed value of the property without taking lender’s mortgage insurance (LMI). LMI is insurance that protects the lender from a loss if the sale of security doesn’t cover the loan. It doesn’t protect the defaulting borrower. And it is very expensive – think a number around $15,000, but varying by loan amount and other variables. With LMI, lenders generally lend up to 90%.

The form of the security must also be acceptable. Obviously the lender must be able to take control and sell the security. There will also be times when lenders will not take security over one type of property or another. An example is say single bedroom apartments in Melbourne, where it is currently deemed the market is saturated.

How to apply for a loan

The channels:

- Branch – the traditional channel. The advantage is that you have a person to help you through the process. The big banks dominate, but the online world is a great leveller. You may have to do a bit more leg work without a branch to go through smaller lenders, but if the deal is good enough it worth the upfront effort.

- Broker – brokers now account for half of the loans written, and equally provide a person to do the hard yards for you. The advantage is that the broker has a panel of lenders and is able to compare deals available and have a feel for which lenders will be most likely to approve your loan. However they don’t set up competitive tension amongst lenders to get you a better deal, as they don’t want to alienate the lenders. Nor do they always have the best deals in the market

- Online – more of the process can be undertaken online, but most lenders have a bit of a hybrid process. Seasoned borrowers should be able to find their way through the process, and the application convenience is appealing when you can find the answers to questions at home.

- Phone – It can work well when the bank knows you well, but it’s not a channel that is promoted, more likely an adjunct to online.

- Comparison site – part of the shopping, comparing and choosing part of the process, not the application and fulfilment.

What you will need to apply

- Pay slips

- Proof of repayments

- 100 points of identification

- Bank statements

- Rental statements

- Confirmation of expenses

- Proof, proof, proof

Post – Royal Commission it is likely to be getting tougher, so be prepared and be patient.

The process and timing

- Choose your preferred lender from use of a comparison site or broker.

- Seek a pre-approval – effectively just an indication that they believe they should be able to approve, other things being equal.

- Find your house, negotiate, sign up subject to finance and inspections, pay deposit.

- If you are buying at auction the conditional contract is not viable and you are placing a lot more faith in the pre-approval.

- Immediately formally apply for the loan as you will only have a couple of weeks for approval before the vendor has the right to rescind the contract.

- Your conveyancing clerk or solicitor does checks on the property to confirm that you are receiving clear title to it.

- When approvals are in place the contract “goes unconditional” and you are bound to settle on the property by the expiry date or risk losing your deposit.

- Your solicitor and the bank settle with the vendor for the clear title to the property. You receive the keys and move and move.

It sounds daunting but people do it every day. It is hectic in the required timeframe.

Home lenders

- The big four banks dominate, with around 80% of the market, through incumbency, distribution and brand, but they are not the lowest priced.

- Second tier Australian banks and subsidiaries of international banks

- Customer owned banks, building societies and credit unions

Mortgage originators which are mono-line home lending businesses and not Australian Deposit-taking Institutions (ADI’s). Raise funds through securitisation of loans and have led on price in recent years.

How banks work, how they make money

Banks are in the business of lending money, one of the inputs for which is the raising of money to fund the loans.

Funding sources

- Capital – banks are required to hold a percentage of their assets (mainly loans) as capital (shares sold to the public and super funds). That is the simple version, with the reality that there are multiple types of capital, all with minimum required levels and the assets are risk weighted. At this point core capital (CET1) stands around 12% and total capital 14% of risk weighted assets. Banks must earn a return on these funds for their investors.

- Household and business deposits – Banks are ADI’s, meaning that they are licenced to raise funds from the public and that the government guarantees those deposits provided the customer’s total deposits with the bank are below $250,000.

- Wholesale funding – securitisation programmes (where the banks take the loans off their balance sheet, effectively selling them off), bond raisings secured by mortgages and other debt issues, raised in Australia and internationally. The high credit ratings of the big banks allow them to raise funds at lower interest rates than their smaller competitors.

Capital aside, banks borrow short and lend long, meaning that funding is short term and frequently rolled over, while loans are lent for long terms 25 / 30 years. This fundamental mismatch adds to bank risk. It is managed by diversifying funding sources and maintaining a strong credit rating, so that it can continue to raise funds favourably. On the lending side of the book, they have unprecedented (compared to other industries) rights to price up the loans.

Lending margins

The banks make their money by charging a higher rate for their loans than they pay to these funding providers. The measure of this is net interest margin.

They put a great deal of energy into managing this margin – by raising funds at a lower cost and lending them at a higher price. In both of these pursuits they are set up for a conflict between earning the return expected by shareholders and managing the business for better customer outcomes. It’s not just the big banks that have this conflict. Even the customer owned segment have to make decisions about how much profit to retain to fund growth and how much to give back to borrowers and depositors by way of more favourable rates. The degree of the conflict changes but not the nature.

Front book /back book

One of the prevalent strategies of the banks for many years has been providing favourable loan rates for new borrowings, sometimes just to new customers, than they charge on existing loans. It’s why you see the variable rate of the banks going up, while special discounts, introductory rates and fixed rates are going down. Effectively the back book is subsidising growth of the front book. This sort of customer relationship behaviour doesn’t sound sustainable but it has survived for quite a while now.

Controversies / developments

- Inter-generational competition – negatively geared investors crowding out first home buyers

- Bank response to APRA qualitative controls on interest only and investment loans, re-pricing the back book

- Loan rates cut for new borrowers not existing borrowers

- Negative gearing

- Cash rate becoming irrelevant as out-of-cycle rate increases become the norm

- Weak control of broker and introducer networks

- Responsible credit breakdown in assessment of affordability and loosening of standards during the property boom

- Falsified loan applications to support approval

- Mortgage stress levels

- Ineffective regulation by ASIC and APRA